Nissan Motor Co., once a symbol of resilience and innovation in the global automotive industry, is now grappling with severe financial distress. As it struggles to stay afloat, the company has made the drastic decision to lay off approximately 9,000 employees worldwide and is actively seeking a financial backer to secure its future. This turmoil underscores the challenges facing traditional automakers in an era of electrification, economic uncertainty, and evolving consumer preferences.

Nissan Faces Financial Turmoil: Job Cuts and Urgent Search for a Backer

A Legacy Under Pressure

Nissan, headquartered in Yokohama, Japan, has a storied history of producing iconic vehicles and pioneering technologies. From the legendary Datsun to the widely celebrated Nissan Leaf, the company has long been a trailblazer. However, recent years have been unkind to the automaker. Declining profitability, management controversies, and strategic missteps have left it vulnerable in an intensely competitive market.

The ongoing economic slowdown, compounded by supply chain disruptions and inflationary pressures, has worsened Nissan's predicament. The company’s struggles to compete effectively in the rapidly growing electric vehicle (EV) segment have also put it at a disadvantage.

Job Cuts: A Grim Reality

In a move indicative of its financial woes, Nissan announced plans to lay off approximately 9,000 employees, representing a significant portion of its global workforce. The layoffs, which span production facilities and corporate offices, aim to streamline operations and reduce costs.

The impact of these job cuts extends beyond the company’s bottom line. Entire communities dependent on Nissan’s factories and offices face economic uncertainty. Countries like the U.K., U.S., and Japan, where Nissan maintains a substantial manufacturing presence, are likely to feel the ripple effects of these layoffs.

The Need for a Financial Backer

To stabilize its operations, Nissan urgently requires a financial backer. Reports indicate that the company is exploring partnerships with private equity firms, government entities, or even competitors in the auto industry. A new backer would provide the much-needed liquidity to address immediate cash flow challenges and support strategic investments in electrification and digital transformation.

Nissan’s hunt for a backer also raises questions about its long-term autonomy. If the company secures funding from a larger automaker, it might face integration or restructuring pressures that could redefine its identity in the global market.

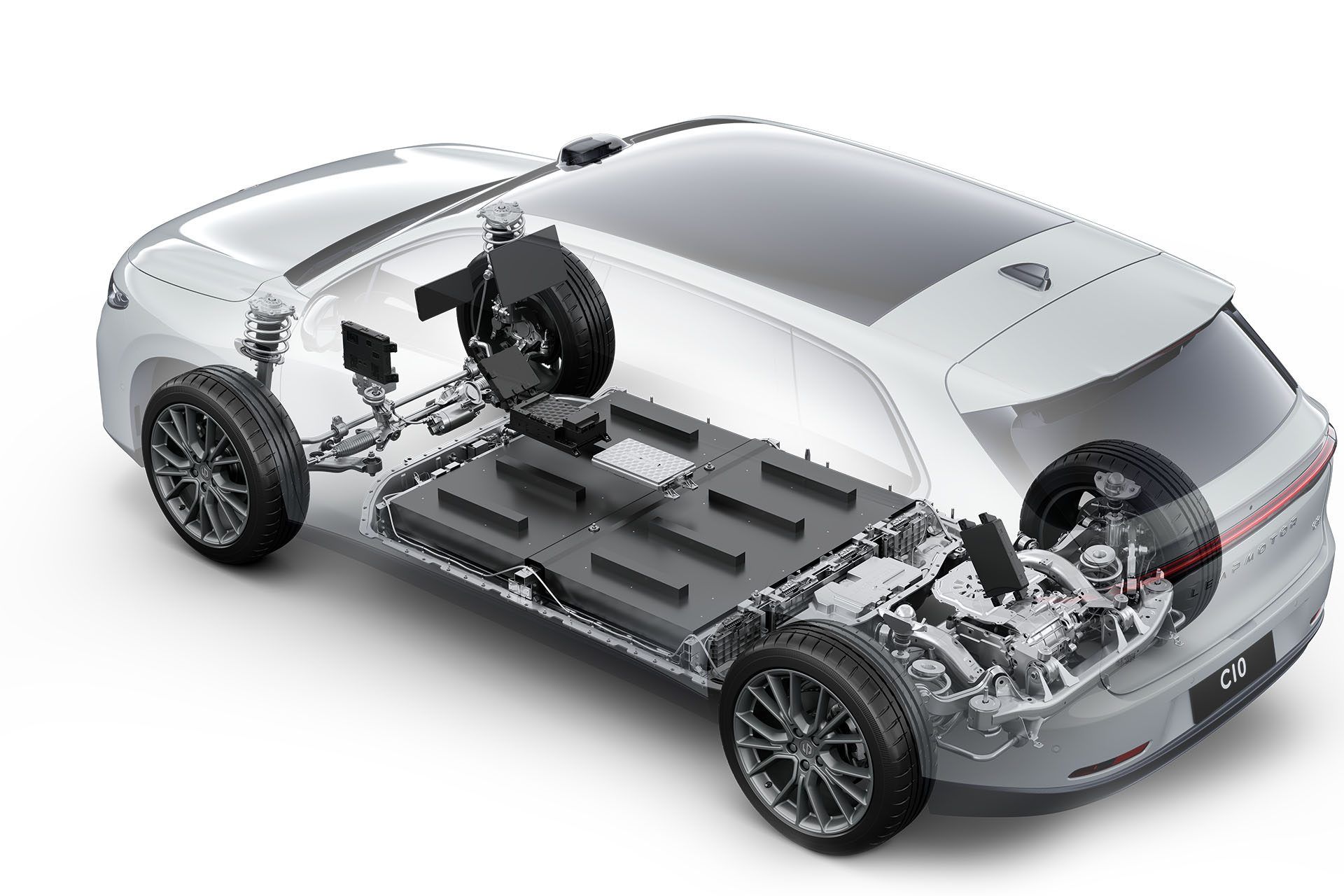

Challenges in the EV Market

One of Nissan’s critical shortcomings is its lagging presence in the EV market, despite being an early entrant with the Leaf. While the Leaf was a trailblazer in affordable EVs, Nissan failed to capitalize on its early lead, allowing competitors like Tesla, Hyundai, and even Toyota to dominate the space.

The shift to electrification requires massive investment in battery technology, charging infrastructure, and R&D, areas where Nissan has fallen behind. Without a backer to fund these initiatives, the company risks losing relevance in the global market.

Rebuilding Trust After Past Controversies

Nissan’s troubles are compounded by lingering fallout from past leadership controversies, including the arrest and escape of former CEO Carlos Ghosn. These events tarnished the company’s reputation and strained its strategic alliance with Renault and Mitsubishi, creating uncertainty about the future of its global partnerships.

The Road Ahead

Nissan’s current predicament reflects a broader industry trend, as legacy automakers grapple with balancing traditional operations while transitioning to new technologies. Without a swift infusion of capital, Nissan’s ability to innovate and compete will be severely hampered.

A potential financial backer could revive the automaker, but it would also demand significant changes. These might include restructuring, divesting non-core assets, or even merging with another industry player.

What It Means for the Automotive Industry

Nissan’s struggle serves as a cautionary tale for other automakers. In a market defined by rapid technological shifts and economic uncertainty, agility and forward-thinking investments are essential. Companies that fail to adapt risk obsolescence, no matter how storied their pasts.

For now, Nissan’s fate hangs in the balance. Whether it can secure a financial lifeline and navigate the challenges of transformation will determine not only its future but also its place in automotive history.