Navigating the Shift: Challenges and Considerations in the Used EV Market

In a landscape increasingly shaped by environmental concerns and technological advancements, the automotive industry is undergoing a profound transformation. As the world moves towards a greener future, the spotlight on electric vehicles (EVs) intensifies. However, recent trends in the used car market raise questions about the feasibility and affordability of this transition for everyday consumers.

According to recent data, nationally, used car sales surged by 7.3% month-on-month in January. Notably, petrol and diesel vehicles continued to dominate the market, comprising 96% of total sales. Meanwhile, the market for used electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) witnessed a decline. This trend sheds light on the challenges surrounding the adoption of EVs in the secondary market.

The disparity in demand between traditional internal combustion engine vehicles and EVs underscores a crucial issue: the perceived value and affordability of used electric vehicles. Despite governmental incentives and a growing emphasis on sustainable transportation, many consumers remain hesitant to embrace EVs in the pre-owned market.

One significant factor contributing to this hesitation is the financial aspect. While the upfront cost of new EVs may be offset by incentives and long-term savings on fuel and maintenance, the same cannot always be said for their resale value. As the market for used EVs struggles to gain traction, concerns about depreciation and lower residual values loom large.

For the average consumer—often referred to as "mum and dad" buyers—this poses a dilemma. How can they justify investing in a more expensive EV when faced with the prospect of diminished returns down the line? The traditional model of purchasing a vehicle with the intention of trading it in for a newer model after several years may not hold the same appeal in the EV market.

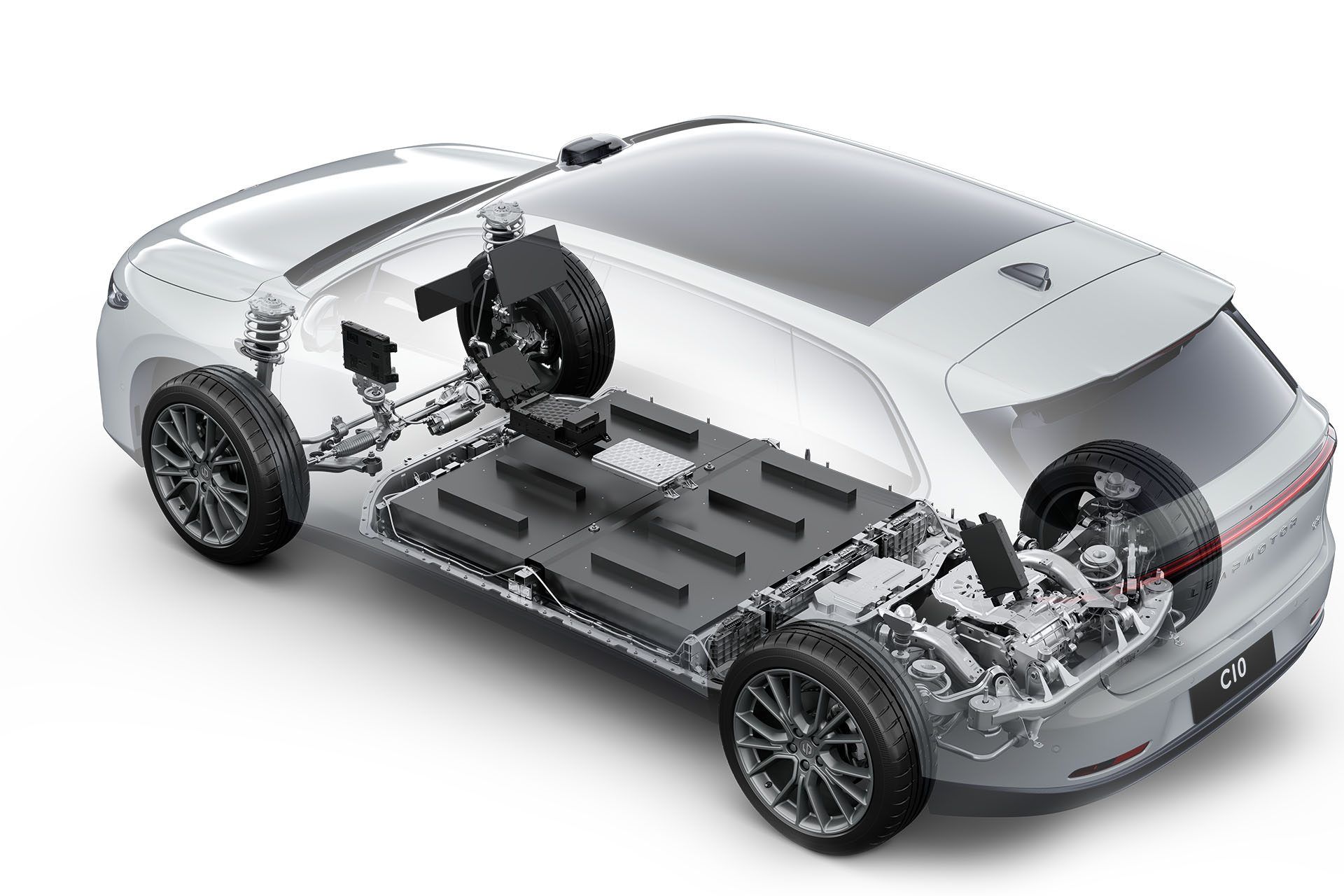

One of the primary reasons for the lower residual value of used EVs is the rapid pace of technological advancement. As newer models with longer ranges and enhanced features enter the market, older EVs may quickly become outdated, further eroding their resale value. Additionally, concerns about battery degradation and the availability of charging infrastructure add another layer of uncertainty for prospective buyers.

Addressing these challenges requires a multifaceted approach. Firstly, there needs to be continued support and incentives from governments to make EVs more accessible and affordable for consumers. This could include measures such as subsidies for purchasing EVs, tax incentives, and investment in charging infrastructure.

Secondly, there is a need for greater transparency and education surrounding the total cost of ownership of EVs. While the initial sticker price of EVs may be higher than their ICE counterparts, highlighting the long-term savings on fuel and maintenance can help consumers make more informed decisions.

Furthermore, manufacturers and dealerships must explore innovative solutions to mitigate concerns about depreciation and residual values. This could involve introducing buy-back guarantees or leasing options that offer greater flexibility and peace of mind for consumers.

In conclusion, while the shift towards electric vehicles represents a significant step towards a more sustainable future, challenges persist in the secondary market. Balancing the upfront cost of EVs with concerns about depreciation and resale value remains a pressing issue for consumers. By addressing these challenges through policy interventions, education, and industry innovation, we can pave the way for a smoother transition to a greener automotive landscape.